Our instructors

RISK MANAGEMENT

What is risk management?

Trading is a game of risk and reward. Finding the balance between the two determines your trading style and your chances of becoming a successful trader. This is also one of the main problems for new traders. One of the first questions a beginner asks is: how much can I make on this trade? This is the wrong approach. The question should always be: How much money can I lose on this trade? Risk management helps you minimize your potential loss while maximizing your potential profit.

In this guide, I explain what risk management is and how to use it to boost your trading career.

Risk management is one of the most important tools for any successful trader. The overall strategy is to minimize your risk and protect your trading account. The main difference between successful and unsuccessful traders is how they handle their losses.

Risk management is an essential tool for any successful trader and the foundation for a successful trading career. Moreover, it is also crucial for hedge and pension funds, trading companies and investors.

Basics of risk management

- Anything can happen in the markets at any time

- Any news or catalyst can positively or negatively affect the price of a stock, commodity or currency pair at any time

- “Trade to live another day”. Instead of going all in, in one trade (which usually ends up with you losing your account), as many beginners do, it is much better to control your risk because if you lose, you can always take another trade and trade the next day

- Never risk more than you can afford to lose

- Always trade with a good RRR (Risk Reward Ratio)

What is RRR (Risk Reward Ratio)

The risk-reward ratio determines how much you risk per trade relative to the expected value of the trade. You should always aim for a higher reward relative to the risk.

For example:

A good rule is to never risk more than 1% per trade (1% rule).

If you follow this rule, a single trade cannot cost you more than 1% of your account value.

Many people misunderstand this rule and think they can only invest 1% of their capital into a certain asset. For example: you have a $10.000 trading account and apply the 1% rule. You can not lose more than $100 in a particular asset (the less the better). You want to buy a stock at $100 and set your SL at $95. So your risk is $5 per share. Since you want to risk $100 per trade, you may buy 20 shares ($5 x 20 = $100). If the stock moves against you and reaches the SL at the price of $95, you lose $100. If the price reaches $110 and you sell all your shares, you make $200 profit ($10 x 20 = $200). Your risk-reward ratio in this case would have been 2:1.

If your target had previously been $115, your RRR would have been 3:1, at $120 it would have been 4:1 and so on.

The best RRR for you depends on your trading style, but it should never be less than 1:1. If you are swing trading, a good risk reward ratio is 2, 3, 4 or 5. For short term trading, it should be at least 1:1. The higher, the better.

The most important rule here is that you should never enter a trade with a risk-reward ratio of less than 1:1. For most traders it should be at least 2:1. I personally like to have a RRR of at least 3:1.

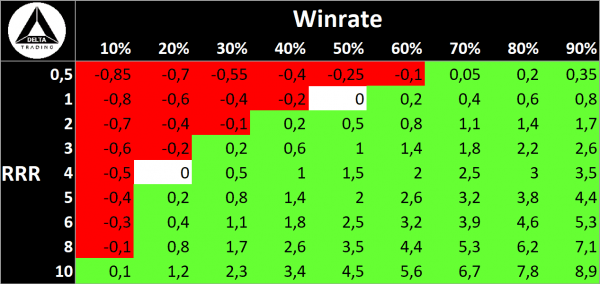

A risk-reward ratio of 1 will allow you to trade at breakeven, if you even lose 50% of the time. With a RRR of over 2, you are still profitable even if you lose more than half of your trades. This means that you are profitable when you have a risk-return ratio of over 2 and a win rate of over 33%.

If you like, you can find the calculations for it here.

Example: If you have a win rate of 50%, your average winner is 1R and your average loser is 1R, the result is +-0

(50%*1)-(50%*1) = 0

If you increase your win rate to 60%, your average result is 0.2R or 20%.

(60%*1)-(40%*1) = 0.2R

If you increase your average return to 2R at a 60% win rate, your average result is 0.8R

(60%*2)-(40%*1)=0.8R